Published: Jul 01, 2022

a world without cash – is it possible

Money — intangible, invisible

The American economist Francis A. Walker famously said that “money is as money does.” His words are perhaps more pertinent now than ever before as societies around the world increasingly embrace digital payments, accelerating the demise of physical forms of money.

In the business payments space, cash payments were already projected to be low in 2017, accounting for only 5 percent of all payments and have likely decreased further since. In the consumer space, cash payments made up around 60 percent of all payments but in recent years reliance on cash has been significantly eroded by the introduction of new digital payment platforms and dramatic growth in e-commerce and the adoption of mobile payment apps. According to Visa’s 2021 Consumer Payment Attitudes Study, less than half of consumers in Southeast Asia (45 percent) deem cash as their most preferred payment method. Preference for cash is lowest in Singapore (15 percent) and cashless payments continue to gain traction, with 10 percent of consumers claiming not to use cash at all.

While the basic functions of money will remain unchanged, we will have to get used to a world in which it is intangible and invisible; a world in which financial transactions involve the transfer of digital information — through the ether, as it were — rather than the exchange of coins or banknotes.

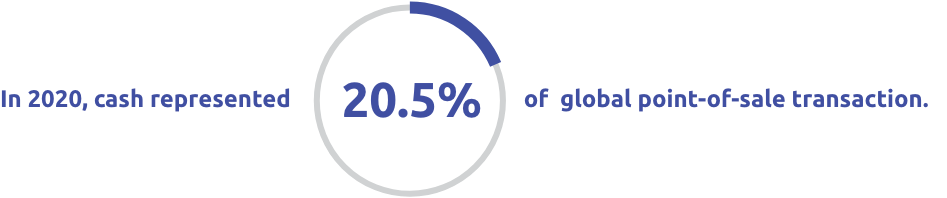

A cashless society is no longer merely a hypothetical proposition. It is fast becoming a reality. According to the 2021 Global Payments Report by Worldpay from FIS, cash represented just 20.5 percent of global point-of-sale transactions in 2020, a dramatic 32 percent reduction from 2019.

Asian economies like China, India, and Indonesia are leading the way in the adoption of cashless transactions. In China, payments via apps like Alipay and WeChat Pay are widely accepted and the country’s mobile payment penetration rate reached 39.5 percent in 2021, according to Statista.

There are reasons to welcome this trend. The World Economic Forum (WEF) asserts that going cashless can benefit societies by eliminating the middlemen in transactions, closing the financial inclusion gap, and making it easier to tackle corruption.

The Covid-19 pandemic has accelerated the adoption of cash-free payment methods across the globe. Companies and government organisations are waking up to the need for greater levels of digitisation in light of this trend, but many face an uphill struggle.

The case for a cashless society

It’s not hard to see why digital payments are gaining popularity — they are more convenient than cash-based ones and can be processed faster. They also eliminate the need for physical interaction between strangers at a time when such interactions are potentially dangerous, as in the case of the recent pandemic. Beyond these clear advantages there are reasons to believe that moving towards a cashless society could bring about lower rates of financial crime.

Non-physical money is inherently harder to steal than cash. Moreover, the greater audit trail of digital transactions could in theory help authorities more effectively tackle corruption and crimes like money laundering and tax evasion.

The rise of cashless payments alone will not be enough to stop financial crimes. Rather, it will force criminals to develop more sophisticated digital methods of committing these types of crime. This is why governments and Financial Institutions (FIs) should leverage advances in technology to prevent, identify, and respond to illegal financial activities. According to the Financial Action Task Force (FATF), digital tools based on machine learning (ML) and other forms of artificial intelligence (AI) have the potential to help organisations better identify risks and monitor and deal with suspicious activity. Hence, Raphael Too, Client Delivery Lead for Financial Services at NCS, asserts that “a lot of what makes cashless society work is centred around how we can establish better regional linkages in terms of payments, and providing that technology layer to monitor and prevent financial crimes.”

The need for real-time security

“One aspect of AML and fraud detection we tend to forget is that everything happens on a very siloed basis,” says Chang Chew Lik, Co-Lead of Financial, Industrial and Commercial Client Service Unit at NCS. Until now, individual banks have been conducting their own AML-monitoring and fraud detection activities and there has been little or no exchange of information between financial institutions, which means that it is hard to get a complete picture of what is going on. Chew Lik argues that standardisation and sharing of data across the financial services industry is needed in order to bring down instances of financial crime.

There is also a growing need for real-time AML and fraud detection as platforms like PayNow allow consumers to make payments in a matter of seconds. As we look to transition to a more cashless society, more effective and economical real-time detection will be needed across the payment platforms to provide security to consumers and providers.

Overcoming challenges

Cash is on the way out. However, there are many hurdles to overcome before we can transition to a truly cashless society and start reaping its benefits. Participating organisations will need to take proactive actions in areas such as identity management, security, and privacy protection.

Countries seeking to accelerate the transition to a cashless society would do well to follow China’s example. The phenomenal growth of platforms like Alipay and WeChat Pay can be ascribed to four key factors:

That being said, societies will only go fully cashless when all citizens are willing to embrace a world without cash. This means overcoming concerns around the security of digital transactions and fraud detection. Given the fact that these transactions can be intercepted by cybercriminals who may steal not just money or property but personal information as well, many people are not yet ready to part ways with cash. Some people are also wary of a payment system which requires that every transaction goes through a financial gatekeeper. With regards to the Asian market, Chew Lik says that “…maybe it will be challenging for us to go into a cashless society, at least in my generation.”

It's important that the transition to a cashless society is gradual if we want to ensure that such a society is as inclusive as possible. As Raphael notes, “…we don’t want to advance so fast to the point where people who are using cash are seen as backwards, which could cause greater digital exclusion.”